Financial Advisory Services

Financial Advisory Services

At Investro, we recognize that managing taxes is one of the most complex challenges facing businesses today. Constantly evolving regulations, strict compliance requirements, and potential risks of penalties mean that taxation cannot be left to chance. Instead, it must be managed strategically, with careful planning and expert guidance.

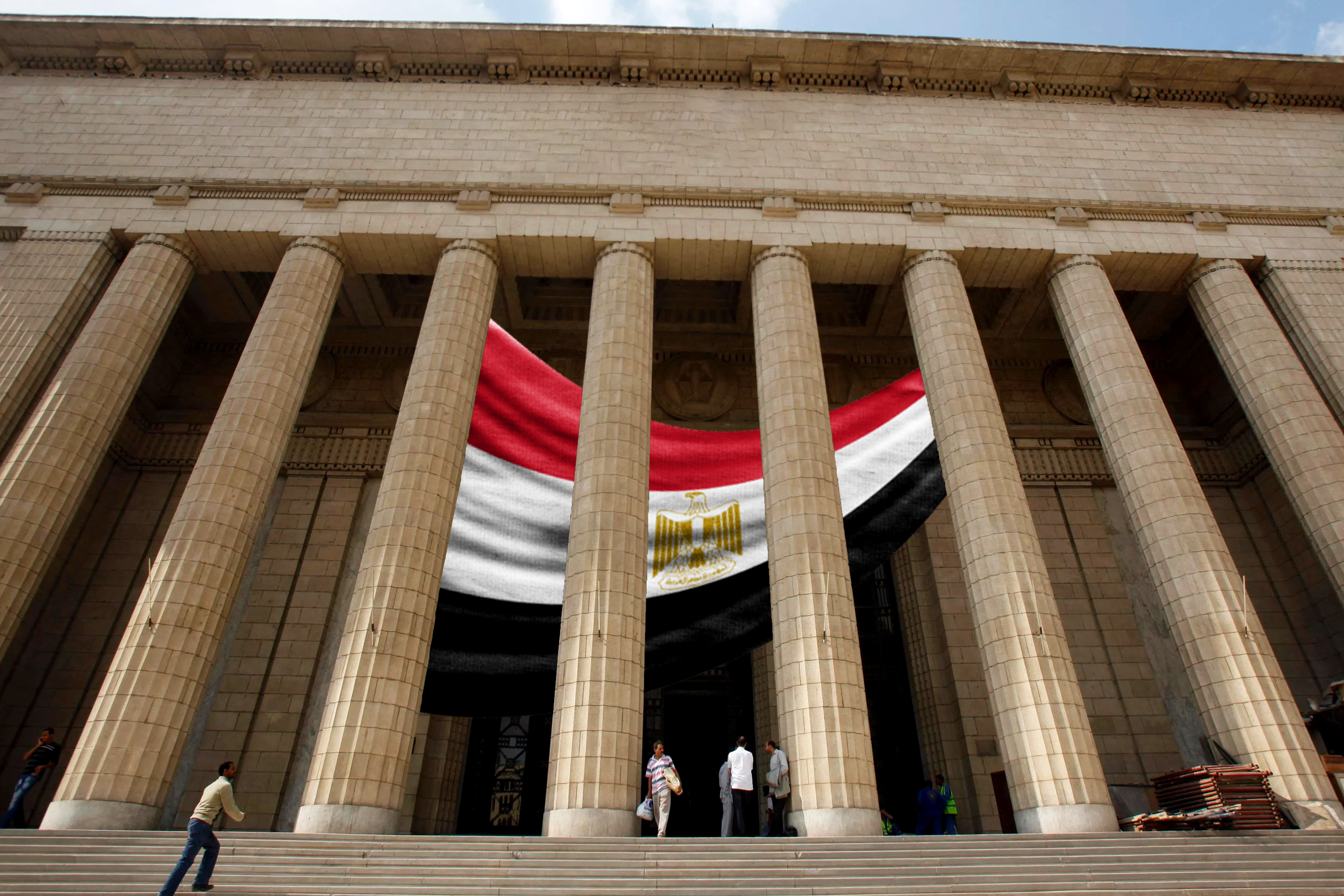

Our taxation services are designed to help businesses minimize risks, optimize tax structures, and remain compliant with Egyptian tax laws while considering international tax frameworks. Whether it is corporate income tax, VAT, payroll taxes, or cross-border taxation, our team of specialists provides solutions that not only meet regulatory requirements but also add financial value to your business.

We work closely with companies across industries to understand their financial goals and design tax strategies that align with long-term objectives. Our role goes beyond compliance—we aim to provide clarity, efficiency, and peace of mind in all tax matters.

By entrusting your tax needs to Investro, you gain a partner who ensures that taxation supports business success rather than creating obstacles.

Our Taxation Solutions

Expert preparation and filing of corporate income taxes, ensuring accuracy and compliance while minimizing liabilities.

Assistance with VAT registration, reporting, and compliance to help businesses avoid penalties and maintain smooth operations.

Accurate calculation and reporting of employee-related taxes, ensuring compliance with labor and tax laws.

Guidance on cross-border transactions, helping businesses benefit from treaties and avoid double taxation.

Proactive tax planning strategies designed to reduce risks, optimize costs, and enhance overall financial efficiency.

Professional representation and support during tax audits or disputes, protecting client interests at every stage.

Trusted Business Partner

Why Businesses Choose Investro

Our team has extensive expertise in Egyptian tax law and stays updated on global tax frameworks.

Our team has extensive expertise in Egyptian tax law and stays updated on global tax frameworks.

We proactively identify potential risks and provide strategies that reduce exposure to penalties or disputes.

We tailor tax solutions to each client’s industry, size, and financial objectives.

By structuring taxes smartly, we help businesses reduce unnecessary expenses and improve profitability.

We stand beside our clients during inspections, audits, and disputes, ensuring they are always protected and supported.